North Atlantic Capital Corporation

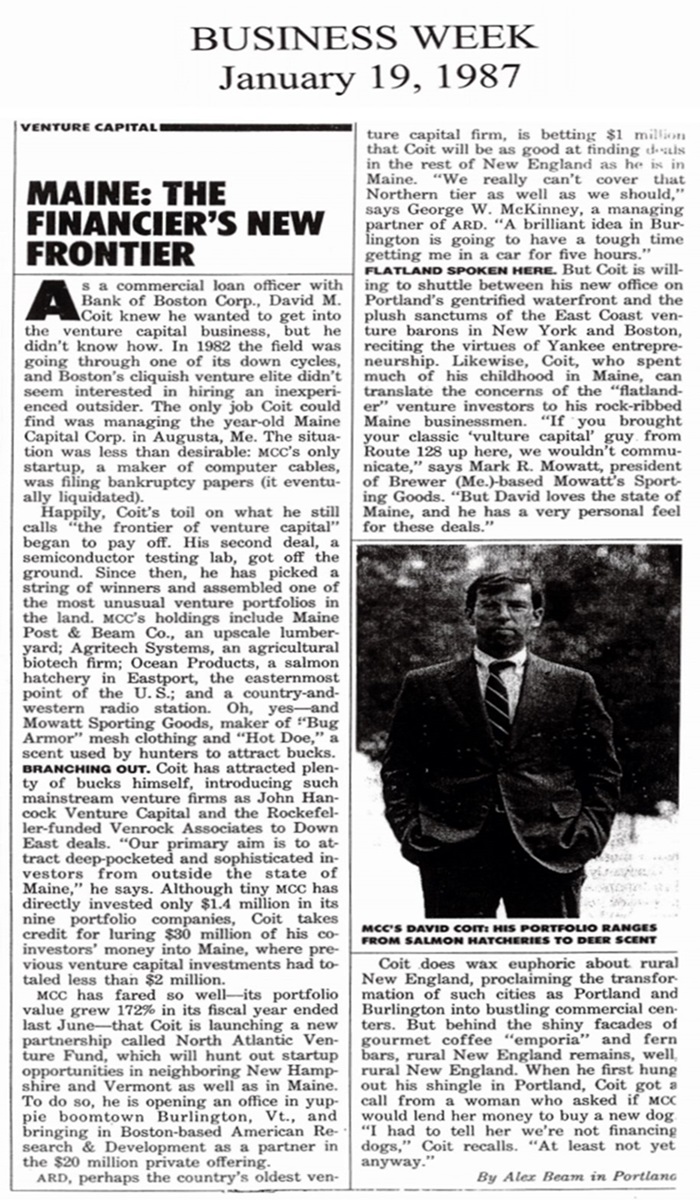

North Atlantic Capital Corporation (North Atlantic) was organized in June 1986, making it one of the oldest venture capital firms in the country. The founding partners, Greg Peters and David Coit, wanted to build a regional business providing risk capital to deserving companies in the four states of Maine, New Hampshire, Vermont and Massachusetts.

One of the first North Atlantic investors was American Research and Development (ARD), the very first venture capital company in America. The early commitment by ARD gave the young partnership credibility in its fundraising effort. The first North Atlantic Venture Fund was capitalized with $17.3 million of mostly institutional investor commitments, which was a very respectable size for a first-time fund at the time.

Given the diverse nature of its target market, the portfolios of the early funds were quite eclectic, reflective of the companies operating in that geography. The range of portfolio investments included everything from early-stage technology companies to buy-outs of mature businesses. Some of the more recognizable local names in the early portfolios included IDEXX Laboratories, WEX, The Hinckley Company and Casella Waste Systems. Three separate funds of increasing size were raised under this regional strategy. The third of these was a Small Business Investment Company licensed and regulated by the U.S. Small Business Administration.

In 2000, Greg Peters retired from North Atlantic, and Mark Morrissette was hired as a new partner in the firm. In 2003, Mark and David undertook a strategic planning process that led to a material change in North Atlantic’s investment strategy. The new strategy involved a much broader geography, encompassing the entire continental United States. At the same time, the new strategy narrowed the focus to investing in established but rapidly growing technology companies. To implement the change and to communicate the change in strategy to the broader market, North Atlantic built a successful cold calling program, which was very rare for small firms at the time.

Over the ensuing 20 years, North Atlantic built its business around providing debt and equity investments to technology companies from Maine to San Francisco. The combination of debt and equity investments was branded “structured capital”, and it became a key differentiating factor in North Atlantic’s ability to compete in what had become a much larger and more competitive industry. In all, three funds were successfully raised and invested incorporating this national strategy. All three of these funds were Small Business Investment Companies.

In 2020, when North Atlantic was raising its seventh fund, Stifel Financial expressed an interest in acquiring the North Atlantic brand and its future business opportunities. In February of 2021, the transaction was consummated, ending a 35-year run for North Atlantic as an independent company. The company was rebranded North Atlantic Capital Management, a Stifel Company, and a new chapter in North Atlantic’s long history began.

North Atlantic recently published North Atlantic Capital, Thirty-Five Year History as an Independent Company, 1986 to 2021. We would like to offer complementary copies of the book to interested members of the North Atlantic community or to academic institutions. If you would like to receive a copy of the book, please contact us at Admin@NorthAtlanticCapital.com.